Learn why it’s important for small businesses to take these proactive cybersecurity measures to qualify for cyber insurance coverage and mitigate losses.

Cybersecurity is an important undertaking nowadays for businesses of all sizes. The latest statistics from IBM’s annual “Cost of a Data Breach Report” show the average cost associated with a data breach rose from a staggering $3.66 million to an even more mindboggling $4.24 million in the past year. This doesn’t even include the numerous other types of cybersecurity events executed by threat actors on a daily basis. In total, losses are in the multi-billions for businesses.

Few businesses can survive, never mind try to thrive, beyond these types of incredible monetary losses, but in the USA cyber insurance can help your company mitigate and absorb some of the risks associated with cyber events. Historically, many businesses haven’t invested in cyber insurance, but with the rising number of incidents each year, companies are starting to consider these policies to protect themselves. Have you examined your company’s risks and coverage options lately?

Cybersecurity insurance works much like other types of coverage policies and is steadily becoming an essential component of any modern cybersecurity preventative strategy. However, it’s important for businesses, especially small and medium-sized companies, to know the cybersecurity industry is in the midst of big changes. As a result, going forward, it’s going to be increasingly more important for SMBs to thoroughly understand the proactive cybersecurity measures they need to take to become qualified for insurance coverage as industry standards for payouts start to become more stringent.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

Cybersecurity Insurance

Cybersecurity insurance is designed to help businesses like yours mitigate losses from the various costly cybersecurity incidents that can occur. In our modern digital age, just about everything is either transmitted, processed, or stored electronically. Loss or exposure of your data is going to be extremely costly, especially as government regulations worldwide expand to become harsher on those companies that haven’t taken adequate or reasonable preventative measures to safeguard data.

In the event a cybersecurity incident occurs, cyber insurance coverage can help pay for expenses associated with the attack, government and industry fines, legal fees, and the costs associated with forensics and/or recovering data, to name a few expenses. Insurance policies can also help your business pay for redress to rectify the problems a cybersecurity event caused affected individuals (e.g.customers and employees) to suffer, such as credit monitoring and ID theft repair.

Types Of Cyber Insurance

The cyber insurance industry is currently evolving to become more standardized like other forms of insurance. In general, a comprehensive cyber insurance policy covers three primary categories of financial risks businesses routinely face.

- First-Party Expenses: This type of coverage covers the expenses from losses that resulted from a breach of a business’s internal systems. Examples of events include extortion from ransomware, theft or loss of data, interruptions in business continuity, PR services to combat the fallout of an event, and any expenses associated with the cost of a cybersecurity incident investigation.

- Third-Party Expenses: This cyber insurance coverage is designed for companies that possess third-party data or those responsible for the development, installation, or management of third-party data. Coverage may pay for expenses resulting from privacy claims from victims, regulatory actions, notifying victims affected, and any lawsuits resulting from the cyber event.

- Cyber Crime Costs: This coverage deals with any financial losses a company suffers that are a direct result of criminal activity.

Businesses are smart to integrate a variety of cyber insurance coverage to ensure all potential scenarios are covered. Events such as extortion, dataloss/destruction, fraud, online theft, hacking incidents, malware, social engineering campaigns, and denial of service attacks can easily cripple any business and significantly disrupt its business continuity.

Cyber Insurance

Currently, the cyber insurance market is in the midst of a huge transformation. In the past, this industry was relatively unknown, but now it is a well-known option and the industry has subsequently begun to gain sudden traction. Due to this rapid growth, the industry wasn’t prepared, didn’t have the historical data to set accurate premium rates, and, due to the continuing uptick of cyber incidents, payouts quickly exceeded the resources to pay for them. This became a larger issue as the number of ransomware attacks exploded. As a result, the cyber insurance market is going to evolve to become more restrictive about what is and isn’t covered. It’s likely in the future, many small and medium-sized businesses may find they have more difficulty obtaining cyber insurance.

That being said, if your business is more proactive about its cybersecurity practices, such as having a comprehensive cyber risk management program in place, you’ll find it might be easier to qualify for a policy or obtain better insurance coverage premium rates. In the future, as this insurance niche begins to become more standardized, insurance companies are going to want to mitigate their own risks so the number of claims doesn’t exceed what the companies are bringing in through premiums.

Cyber Insurance Policy

A solid cyber insurance policy can help your business mitigate losses that result from a cybersecurity incident. Investing in a policy can not only help your company transfer the residual risk via cyber insurance, but improve your company’s overall security posture. The latter is essential to reducing risks, especially as the number of ransomware attacks continues to rise at exponential rates. In 2020, this type of attack increased a whopping 485% over 2019 and the demanded ransom amounts have tripled. Even insurance companies are being targeted by these threat actors, which creates a unique, significant problem in itself.

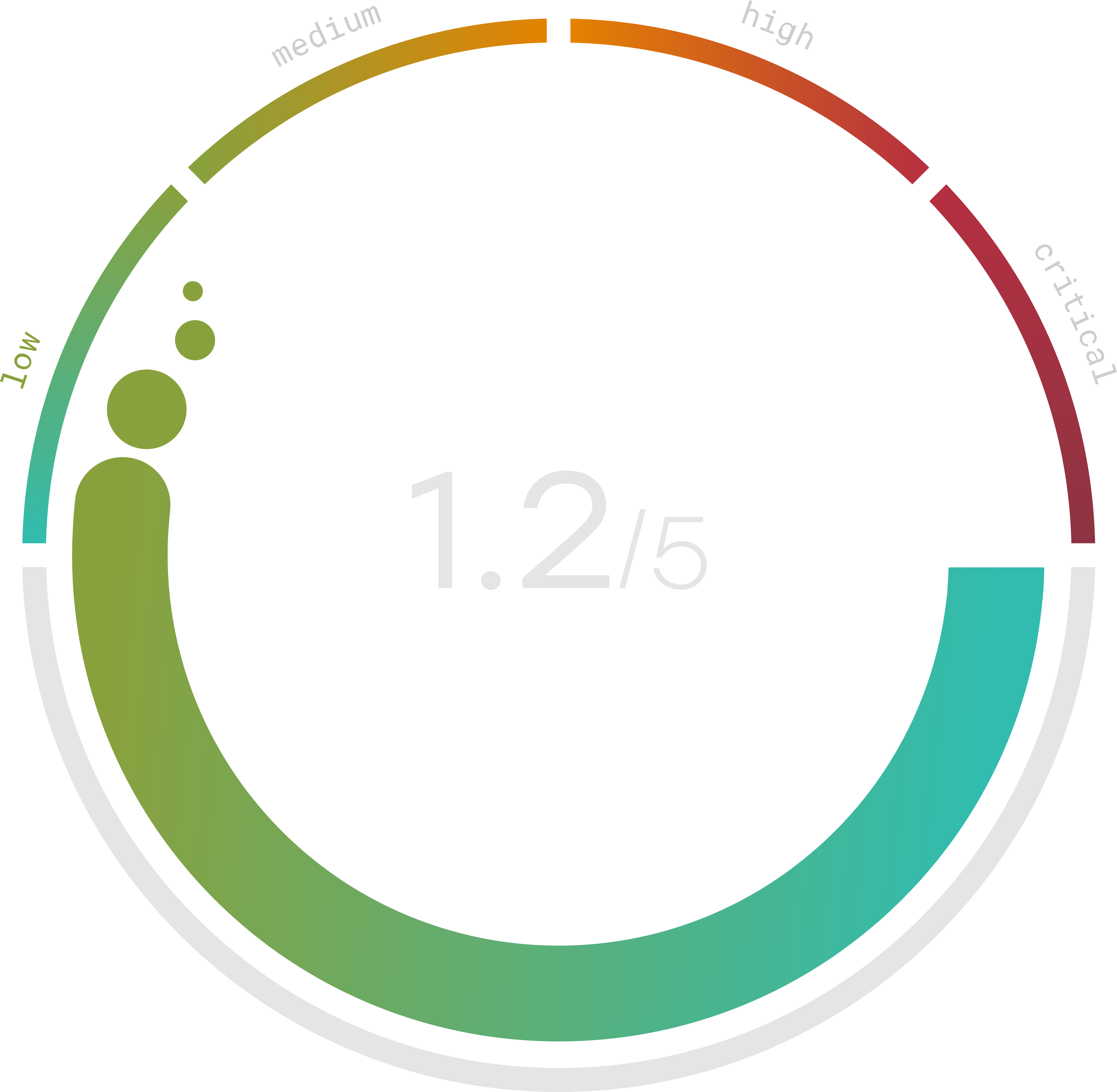

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Cyber Insurance Coverage

Today, cyber insurance coverage should be considered as important as other types of insurance businesses need to invest in. Essentially, all companies should create a cyber insurance coverage checklist to determine the highest risks and what type of coverage is best. When shopping around for insurance, it’s important to know what cyber insurance covers—and, as important, what cyber insurance does not cover. Company decision-makers need to understand not every policy covers each type of claim. For instance, the following are typically excluded from cybersecurity insurance:

- Property damage (e.g. hardware destroyed by an attack)

- Loss or theft of intellectual property

- Crimes and/or self-inflicted cyber incidents

- Costs of cybersecurity protective measures

- Future loss of profits

To have these events covered, other types of insurance, such as general liability, commercial property, and professional liability insurance should be obtained. As the industry evolves, it’s important for small and medium-sized companies to keep up-to-date with the changes.

Cyber Risk Insurance

Even companies with the best mitigation efforts in place are still likely to suffer an attack. For the most part, nowadays it’s not “if” a cybersecurity attack occurs, it’s “when.” Integrating cyber insurance as part of an overall security strategy will help ensure all proverbial bases are covered. Most cyber incidents are related to humans, be it by an intention to exploit or a result of an employee’s accidental exposure of data or giving up credentials to hackers. Protecting yourself can reduce the impact after an event occurs.

Considering the consequences, no business can afford to ignore cybersecurity or cyber insurance options. Turning to an experienced cybersecurity provider can help offset costs and help your company identify the right cyber insurance options that will offer the most comprehensive coverage.

Sources

- https://www.washingtonpost.com/politics/2021/09/14/cyber-insurance-may-not-be-making-companies-more-secure/

- https://www.chicagofed.org/publications/chicago-fed-letter/2019/426

- https://cyberinsureone.com/types/

- https://www.cohencpa.com/insights/articles/5-cyber-liability-insurance-fundamentals-for-your

- https://www.thehartford.com/cyber-insurance

- https://woodruffsawyer.com/cyber-liability/cyber-101-liability-insurance/

- https://www.nerdwallet.com/article/small-business/cybersecurity-insurance#what-are-the-types-of-cybersecurity-coverage

- https://www.wsj.com/articles/as-ransomware-proliferates-insuring-for-it-becomes-costly-and-questioned-11620811802